One of the most confusing aspects of travel management is handling employee travel expenses. Knowing what can and cannot be reimbursed can cause headaches for even the most seasoned travel manager—especially when it comes to mileage reimbursement.

Below, we tackle the most common questions so that you can formulate a travel policy that is fair and equitable for both the business and employees.

Mileage Reimbursement Law for Employees

For many businesses, the ability for an employee to use their own vehicle for work purposes is convenient and often necessary. The question then is who incurs the costs of doing business associated with travel? Are employers required to reimburse mileage and other expenses, or do employees take them on instead? What does the law say about the matter?

In fact, there is no federal law that says employers must pay mileage reimbursement to their employees, and state laws may vary by region. However, paying mileage reimbursement does offer benefits for both parties. Among those benefits for employers is that paying mileage reimbursement is an excellent way to attract top job candidates and retain them.

Both employers and employees also see tax benefits from mileage reimbursement. As reimbursements are not considered taxable income by the IRS, employees are not required to pay tax on them. Conversely, employers receive a tax break because mileage reimbursements are considered a deductible expense. It is a win-win for everyone.

How to Implement a Mileage Reimbursement Policy for Employees

If your company decides to pay mileage reimbursement, crafting a clear and concise policy is a must. Questions will arise, so your policy should meet some basic criteria. First, reimbursement is for deductible business expenses, which means business travel. Employees should keep records of the time, place, and purpose of the travel, as well as the number of round-trip miles.

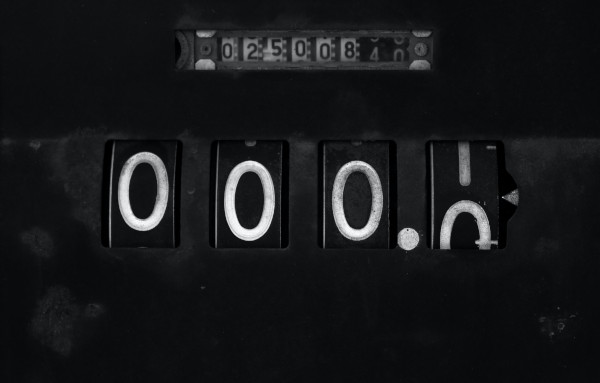

The next question employers ask is how much do we pay for mileage reimbursement? The IRA releases an annual optional standard mileage rate. The average rate for 2019 and 2020 was 57.5 cents per mile. Notice the rate is called the optional standard rate, as employers can choose whatever rate they wish. Some choose a lower rate.

Another point to keep in mind is that the geographic location of travel will likely determine the mileage reimbursement rates your company chooses. In other words, the cost to travel varies significantly across different states and regions. Therefore, those traveling for work in a more expensive area such as California will likely see a higher rate than someone traveling in the Midwest. Why? Because fuel costs, insurance rates, and other expenses can vary greatly from region to region.

Mileage Reimbursement for Employees

What should your employees reasonably expect to recover in terms of travel expenses when they use their own vehicle for work? Your mileage reimbursement policy should spell this out in detail. For example, do employees get reimbursed for their commute to and from work? What if they make a detour for a personal errand while traveling for work? Some companies may even require traveling a certain distance (such as 10 miles from your start location) before reimbursement can be requested.

For nearly all companies, personal trips and travel to and from home are excluded from reimbursement.

Guidelines should be clearly defined on what policy violations are and what the penalties or disciplinary measures are for violations. A rigorous documentation system should be adopted to ensure policies are adhered to and both employer and employee are safeguarded.

A well-crafted mileage reimbursement policy will pay dividends to both employers and employees. Take time to communicate the policy’s guidelines and encourage questions so that each party feels comfortable.

Partner with CLC Lodging to help streamline your business’s employee travel management.

Recent Posts

-

.jpg)

U.S. Trucking Transportation Trade Shows and Conferences

Jan 23, 2025 | -

Demolish the Biggest Frustrations in Construction Travel

Nov 19, 2024 | -

Thanksgiving 2024: What Restaurants are Open for the Holiday?

Nov 19, 2024 |